Net zero or growth?

How Belgium can have both.

A look at the McKinsey 2023 report with a focus on the built environment.

A look at the McKinsey 2023 report with a focus on the built environment.

Under the Paris Agreement, Belgium has committed to reaching net-zero greenhouse gas emissions by 2050. Given its dense population and highly industrialized economy, Belgium ranks 7th in CO₂ emissions per capita among the 27 EU countries.

In a recent report, McKinsey & Company provides an in-depth analysis of Belgium’s potential to achieve this goal and drive green economic growth. The report highlights the necessary actions and investments across key sectors to overcome these challenges, while also exploring the business opportunities the global net-zero transition could unlock for Belgian companies and the economy as a whole.

As strong advocates for sustainable construction, we’ve summarized the key takeaways from the report related to the built environment.

Let’s dive in!

Belgium has a unique opportunity to reduce its reliance on foreign energy. Currently, the country supplies only 5% of its energy needs domestically, but by following a net-zero pathway, it could increase that figure to 50%.

Achieving this would require:

To align with net-zero objectives, both new and existing buildings must undergo a massive energy transformation. Specifically, nearly 5.5 million of Belgium’s 5.7 million building units must achieve an A-label energy performance certification. This will require a mix of:

Deep energy retrofits, which reduce energy consumption by 60% or more, are crucial. These improvements include better insulation, the adoption of heat pump technology, and the expansion of district heating systems. However, this is a complex challenge due to Belgium’s older, larger, and less insulated buildings, as well as its historical city centers.

To meet these targets, the energy retrofit market could double, while the pace of deep retrofits would need to increase 25-fold—from 10,000 buildings per year today to 250,000 by 2030.

This transformation will require:

🔹 Massive demand for building materials and skilled labor

🔹 Innovations in sustainable, efficient, and cost-effective construction methods

🔹 Immediate adaptation of training and education programs

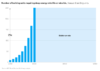

According to McKinsey’s analysis, achieving net-zero will require an incremental investment of approximately €415 billion, with buildings and power accounting for the largest share.

Breakdown of Investment Responsibilities:

The scale of this transition is unprecedented—but so is the opportunity to build a more sustainable, energy-efficient, and resilient Belgium.

The challenge is great, but the potential impact is transformational.

Are we ready to build the future?

The global sustainability shift is not just a challenge—it’s also a huge economic opportunity. For Belgium, this means capitalizing on the emerging building retrofits and rebuilds market.

European-wide demand: Countries across Europe will need to retrofit, rebuild, or construct new buildings to meet net-zero targets.

Decisions on structural investments must happen fast—within the next two years—due to the long lead time for implementation.

The transition is urgent, the investment is massive, but the potential impact is transformational. Belgium has a unique chance to lead the way in sustainable construction—will we seize it?